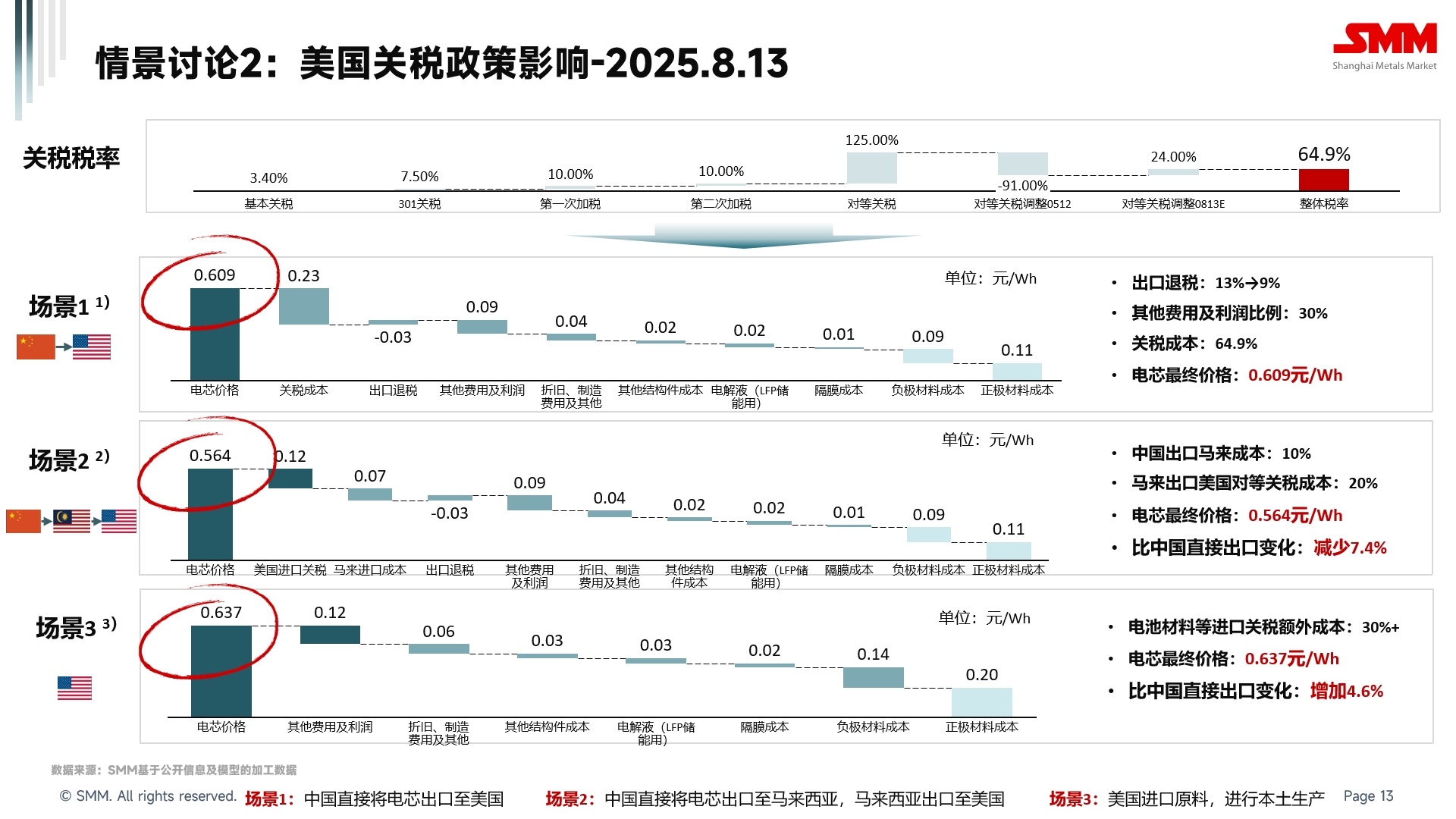

This article is the second in a series exploring the export methods and price impact of Chinese energy storage cells to the US under the backdrop of US tariffs on China. As mentioned in the previous article, although the uncertainty of US tariffs on China has increased, according to the current energy storage tariff measures being implemented, there are three key time points: May 14, 2025, August 13, 2025, and January 1, 2026, with tariffs at 40.9%, 64.9%, and 82.4%, respectively.

This article aims to analyze the price impact of energy storage cells produced in China and exported directly, transshipped via Malaysia, and locally produced in the US from August 13 to January 1, 2026. Some of the data used are theoretical, which may make the results appear on the higher side. The author will try to explain the reasons for each data point in detail so that readers can replace the relevant data to obtain more targeted conclusions. The third article in this series will focus on the price impact caused by tariffs after January 1, 2026.

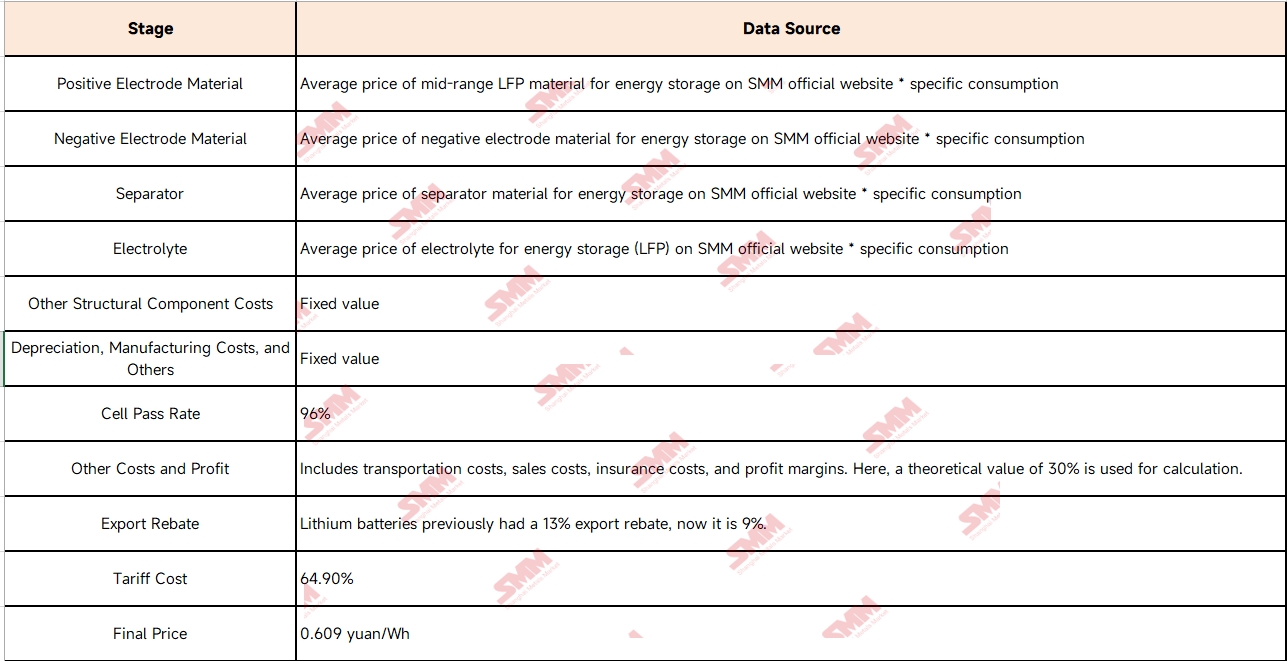

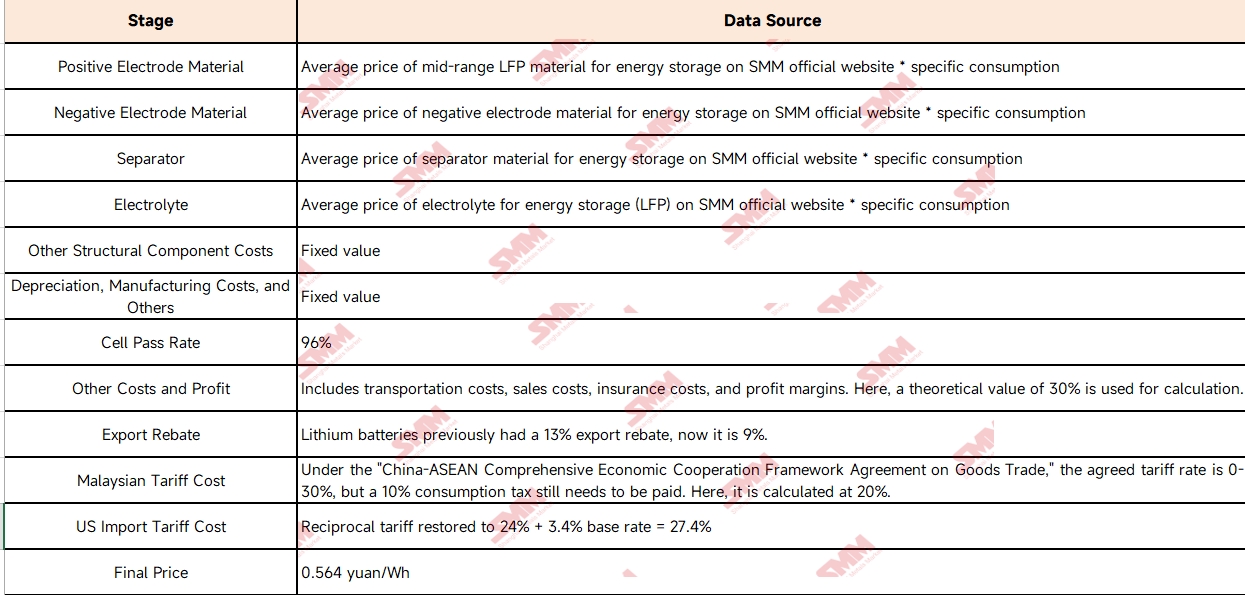

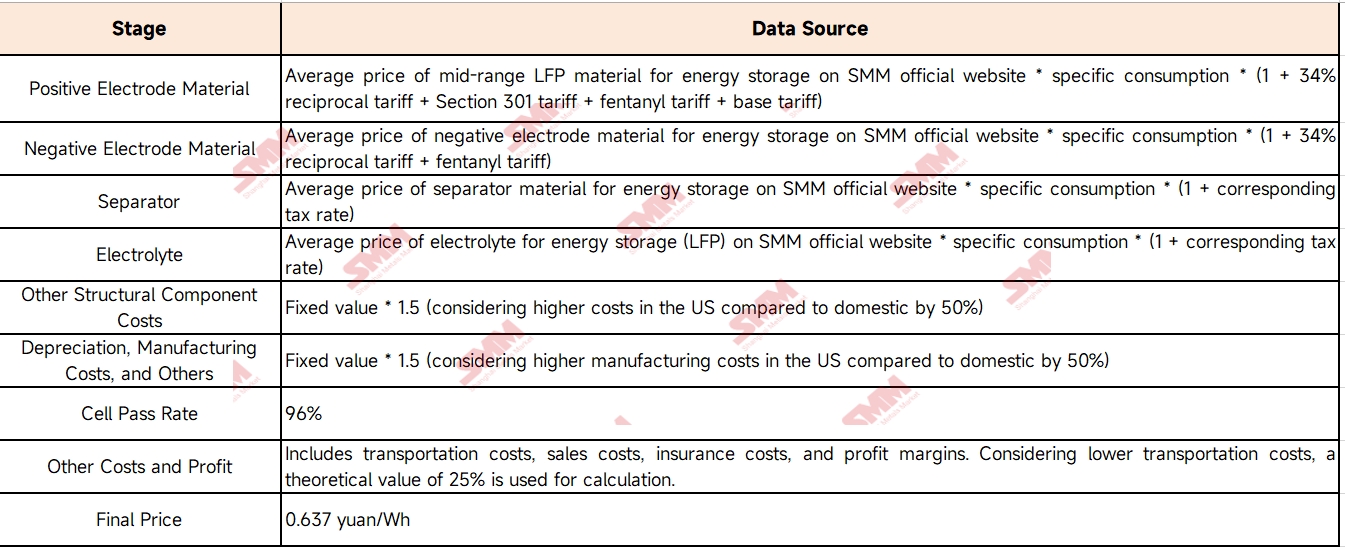

Taking the 280Ah lithium iron phosphate energy storage cells produced domestically as an example:

(1)The data sources and changes for each link are shown in the following table: Direct export from China to the US:

(2)The data sources and changes for each link are shown in the following table: Transshipped from China via Malaysia to the US:

(3)The data sources and changes for each link are shown in the following table: Local production of LFP (Lithium Iron Phosphate) cells in the US:

To sum up the above calculations, before January 1, 2026, and after August 13, 2025, based on the direct export price of 0.609 yuan/Wh from China, the transshipment via Malaysia has a price advantage of 7.5%. Meanwhile, the cost of directly producing energy storage cells in the US is still 4.6% higher than that in China.

The above summary is organized as follows:

Note: Some of the calculated data were obtained by the author through communication and processing in the market, while more data originated from the average prices of various stages on the SMM official website. In addition, in the current actual operations, the increased costs resulting from the U.S. tariffs on China are mainly borne by overseas clients. Therefore, the results calculated in this article may be higher than the actual transaction prices. Any improper aspects are welcome to be criticized and corrected by everyone.

SMM New Energy Industry Research Department

Cong Wang 021-51666838

Xiaodan Yu 021-20707870

Rui Ma 021-51595780

Disheng Feng 021-51666714

Yujun Liu 021-20707895

Yanlin Lü 021-20707875

Zhicheng Zhou 021-51666711

Haohan Zhang 021-51666752

Zihan Wang 021-51666914

Xiaoxuan Ren 021-20707866

Jie Wang 021-51595902

Yang Xu 021-51666760

Boling Chen 021-51666836